Today was National Insurance Awareness Day for 2025! It is the day to do something. . .Be aware and be prepared! Here are some important tips and pointers on keeping yourself safe having proper insurance!

💵 Insure Ahead of Time

Insurance provides a sense of security by safeguarding our loved ones and helping us recover from losses caused by damage, illness, or death. While it offers protection, the value of our homes and belongings may increase or fluctuate over time. Something that was valued at $100,000.00 ten years ago could be worth significantly more today. It is important to ensure that our insurance policies are adjusted to reflect these changes in value.

Insurance Disclaimer courtesy of Openverse

📋 Being Prepared

Replacing all our belongings would be challenging in the event of a disaster, regardless of our place of residence. Whether it’s our first apartment or a 30-year mortgage, our possessions, property, family members, and even guests should be safeguarded by a homeowners or renters policy.3

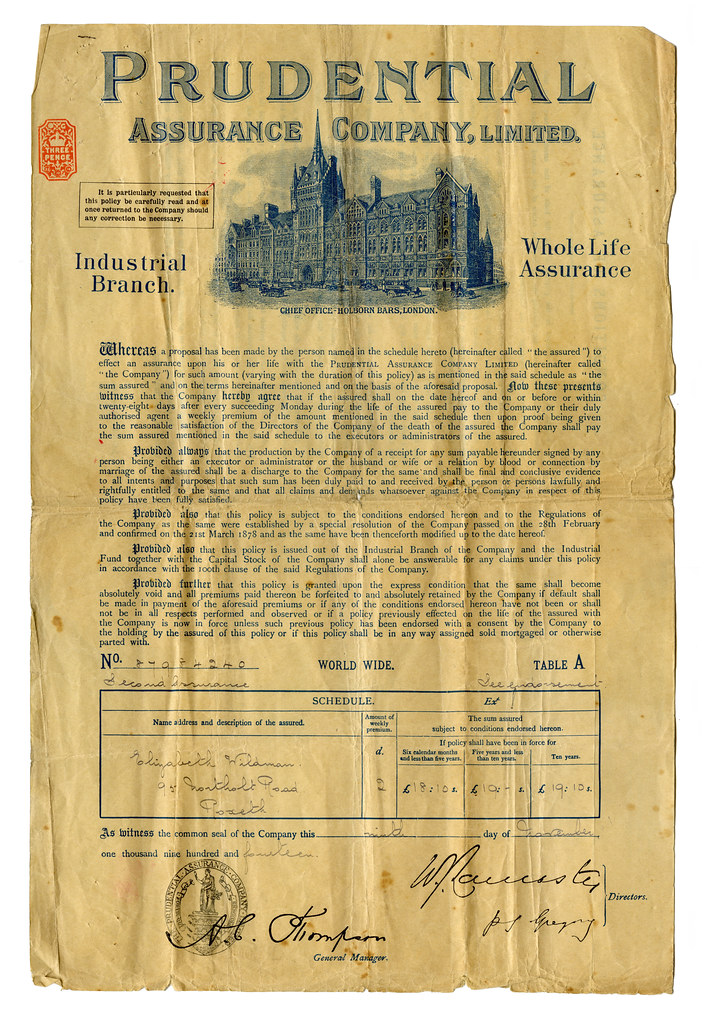

Prudential Insurance Policy courtesy of Openverse

🏥 Encouragement To Review Insurance Policies:

The event provides a chance to gain further insight into the various policy options that are accessible. Here are a few factors to take into account:

- Quotations before need of a policy: Obtain a complimentary estimate – an excellent method for tenants or individuals contemplating a new policy to compare prices.:

- Evaluate your current possessions: Information before a problem arises is crucial to forgoing a loss on what could be covered under the umbrella of an insurance policy:

- Take stock of what you currently own.

- Assess the things you currently have in your possession.

- Changes to current needs for insurance. . .keeping policies up to date: It is crucial to keep you family’s safety and welfare up to date, having your insurance up to date as well:

- Are there any changes in your family structure?

- Have there been any new additions?

- Have some members moved out?

- How many pets do you have at home?

- Plans to buy a new home: If you are considering buying a new home, keep in touch with your insurance agent.:

- The inspection of your home was successful, and it seems like you’re progressing with buying your new home

- Before the closing, make sure to get insurance for your new home

- Get homeowners coverage, explaining important protections for your home and belongings

- Inquire about discounts for combining your car and home insurance to save more money for new furniture or home upgrades.

- Have more insurance on any home or property that you may need, before coverage is needed.

- Consult and review you homeowner’s policy every year upon renewal to make sure that the policy is up to date with your family’s needs, and to keep up with inflation.

- Do you need flood insurance? There it is! A flood happened, and you go to make a claim on your homeowner’s policy, and the bad news is rendered: no coverage due to a flood in a flood zone. . .always hire a professional inspector to not only inspect your house before buying, make sure they do a thorough floodplain inspection! These maps are online at FEMA’s Flood Map Service Center Portal:

- Insurers should know whether or not you are in a floodplain before a problem arises. Make sure that you have a waiver in writing, if you think you live near a flood plain, or neighbors have flood policies and you do not..

- Mortgagers should most positively know whether or not you are in a floodplain before a problem arises. Often times, a mortgager will not extend credit on a land area/housing unit without having the proper flood insurance policy before the loan is taken out. The mortgager constantly receives updates to the status of maintaining the policy for the life of the loan. Many times the mortgager will require that they pay for the flood insurance policy out of a maintained escrow account. . .in order to be positive that the flood policy is in force for the term of the loan..

- Are there going to be big changes ahead that will influence the amount of insurance that you will need? Various life events can influence your finances and impact your life insurance requirements. Some events may be minor, such as a pay raise or relocating to a pricier area. Others, like becoming a parent or experiencing a loss, are more substantial. It’s crucial to understand that having the right financial protection can assist you in navigating through life’s challenges. Therefore, it’s important to acknowledge both minor and major life events and adjust your financial planning (including insurance coverage) accordingly. Here are four key life events that can greatly affect your life insurance needs:

- Getting married

- Having children

- Moving from one location to another

- Buying a home

- Retiring

- Changes to your financial planning

- If you rent, have renters insurance: Renters insurance covers your belongings in a rented place from theft, fire, or sewer backup, and will compensate you for any lost or damaged items. It can also provide liability protection if someone gets injured on your property. Renters insurance protects your personal property in a rented apartment, condo or home from unexpected circumstances such as theft, a fire or sewer backup damage – and will pay you for lost or damaged possessions. It can also help protect you from liability if someone is injured on your property:

- Your belongings from damage, despite the fault of others.

- Theft of your belongings whether you are home at the time or not

- Damage to your belongings due to an incidence

- Injuries to others on your rented space

- Auto insurance . . .more than mandatory: You might be familiar with how auto insurance operates, but are you aware of the various kinds of car insurance available? Understanding the different types of auto insurance and their coverages is crucial when looking for the right policy. Here are some basic car insurance types, their functions, and what they include:

- Liability coverage (mandatory in many states) covers the property of parties you are at fault with getting involved in an accident

- Collision insurance covers the cost of an accident to the portion of car that belongs to the policy holder, not other parties

- Comprehensive insurance can offer an additional layer of protection in the event of a collision with another vehicle, and non-collision incidents, assisting in covering the costs of repairs to your vehicle resulting from such as:

- Vandalism

- Specific weather conditions

- Collisions with animals

- Uninsured motorist insurance provides protection for you and your vehicle in the event of accidents involving uninsured drivers or hit-and-run incidents. This type of insurance is commonly combined with underinsured motorist coverage

- Underinsured motorist insurance provides protection concerning the numerous motorists that opt for the bare minimum in liability coverage in order to cut costs not offering sufficient protection in all cases. Underinsured motorist insurance can safeguard you in case of a collision with a driver whose insurance falls short in covering the expenses

- Medical payments coverage provides protection concerning the medical expenses resulting from an accident. Often times they can come with a hefty price tag. Medical payments coverage offers assistance in covering medical expenses associated with a qualifying accident, irrespective of fault. Sometimes this is paired with personal injury protection insurance, because some policies have a limitation to include other people other than the owner of the policy

- Personal injury protection insurance can provide coverage for specific medical costs and income loss that arise from an accident that is covered by the policy. The extent of coverage under personal injury protection may reach up to 80% of medical and related expenses related to a covered accident, depending on the policy limits

- Gap insurance provides protection concerning the depreciation of a car’s value can occur rapidly, potentially leaving individuals with an auto insurance settlement that falls short of covering the remaining loan amount. In such cases, gap insurance can assist specific drivers in bridging the financial gap resulting from a total loss or theft of their vehicle.

- Towing and labor insurance provides protection concerning the coverage for both the cost of a tow and the expenses associated with repairing your vehicle. Sometimes you are able to obtain a policy for towing only, at a reduced cost.

- Rental reimbursement insurance provides protection concerning the cost to rent while a car is impaired or being repaired due to being involved with an accident. It can be costly to find alternative transportation after an accident. Rental reimbursement insurance covers the cost of a rental car if your vehicle is inoperable following an accident

- Classic car insurance provides specialized coverage designed for the unique needs of owning a vintage and classic car or a collectors’ model. Vintage and classic car insurance offers tailored protection specifically crafted for the distinct requirements of vintage and classic car enthusiasts. Determine whether classic car insurance suits your needs

- Do you have health insurance? Health insurance plans differ in what they cover and how much they cost. You will also see insurance brands associated with the care levels. Some large national brands include Aetna, Blue Cross Blue Shield, Cigna, Humana, Kaiser, and United. Each plan requires a fixed payment towards the average person’s expenses.

-

- Standard Health Policies: The specifics of each plan can differ. The deductibles, which is the amount you must pay before your plan covers 100% of your medical expenses, can vary depending on the plan, usually with the cheapest plan having the highest deductible:

- Platinum: covers 90% on average of your medical costs; you pay 10%

- Gold: covers 80% on average of your medical costs; you pay 20%

- Silver: covers 70% on average of your medical costs; you pay 30%

- Bronze: covers 60% on average of your medical costs; you pay 40%

- Catastrophic: Catastrophic policies pay after you have reached a very high deductible ($8,700 in 2022). Catastrophic plans must also cover the first three primary care visits and preventive care for free, even if you have not yet met your deductible

- Standard Health Policies: The specifics of each plan can differ. The deductibles, which is the amount you must pay before your plan covers 100% of your medical expenses, can vary depending on the plan, usually with the cheapest plan having the highest deductible:

Photo by Kostiantyn Li

Each insurance brand may offer one or more of these four common types of plans:

-

-

- HMOs (Health maintenance organizations)

- PPOs (Preferred provider organizations)

- EPOs (Exclusive provider organizations)

- POS (Point-of-service plans)

- HDHPs (High-deductible health plans), which may be linked to HSAs (health savings accounts)

- Medicare is a health system geared up to meeting persons who are on Social Security. It has the following typical coverages:

- Medicare Parts “A” (hospital insurance) covers inpatient care in hospitals, skilled nursing facility care, hospice care, and home health care

- Medicare Parts “B” (doctor’s insurance) helps cover medical services like doctors’ services, outpatient care, and other medical services that Parts “A” doesn’t cover

- Medicare Parts “C” (MA) also known as Medicare Advantage (MA) plans, are an alternative to Parts “A” and B of Medicare that bundle coverage from multiple parts into a single health plan. NOTE: You cannot have Parts “A”, B & C at the same time; only “A”&”B” or “C”. Your standard Medicare coverage ends when you enroll in a Type “C” program. These plans are offered by private companies that are approved by Medicare and must follow Medicare rules. MA plans typically include coverage for Parts “A” (hospital insurance) and Parts “B” (medical insurance), as well as Parts “D” (prescription drugs). They may also offer additional benefits, such as:

- Vision

- Hearing

- Dental

- Health and wellness programs

- Fitness programs

- Gym memberships

- Transportation to doctor visits

- Over-the-counter drugs

- Medicare Parts “D” (prescription insurance) helps cover the cost of prescription filled. Parts “D” is sometime necessary with and/or without a Parts “C” plan, depending on if the insurance is covered in the Type C plan. You need to have a Type D Plan to supplement your parts “A” & “B” or your prescriptions will not be covered.

- Medicaid is an insurance plan ran by each of the 50 states with Federal funding to incur coverage to individuals that are either have financial issues or fall below the poverty guidelines for the state whereby assistance is applied for and approved by the state’s board of a state department of health, human and/or family services. Each state governs how coverage is extended, and it is up to the person on Medicaid to understand that coverage before a medical issue arises, so that it is completely clear how the coverage will be implemented.

- Medical flexible spending account (FSA) is like a bank account usually sponsored through employment and/or self-employment, except instead of making withdrawals or writing checks, the funds in the account are used to pay for medical expenses. A flexible spending account (FSA) is a valuable employee benefit that enables you to allocate funds from your salary before taxes are deducted, specifically for covering healthcare and dependent care costs. Unlike a health savings account (HSA), an FSA is not managed by your health insurance provider. Nevertheless, it remains a useful tool for reducing your taxable income. Remember to spend any remaining Flexible Savings Account funds before they expire.

-

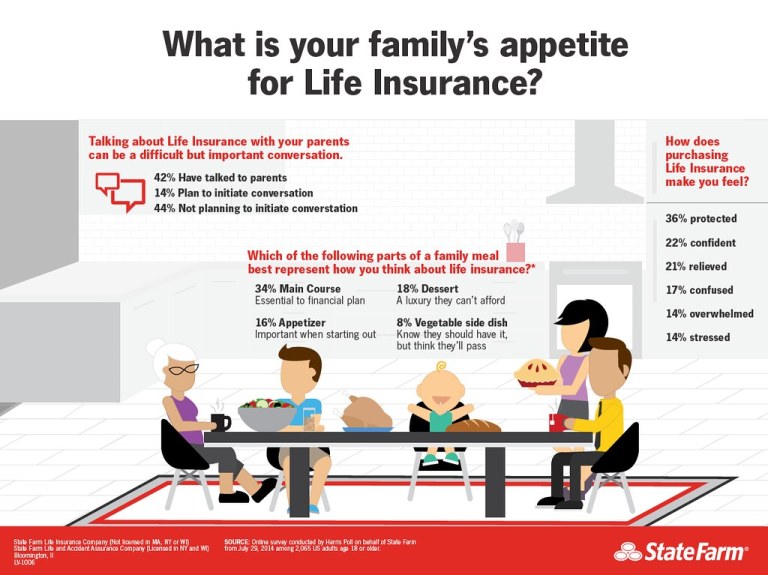

What’s Your Family’s Appetite for Life Insurance courtesy of Openverse

- Do you have life insurance? Life insurance insures the survivors of your estate, once you pass. It is integral that you make proper accommodations before you are no longer around to do so. Here are some different types of policies available on the market including two main types of life insurance:

- Term life insurance covers the death during the term. The amount is disclosed before inception. They offer terms for renewal, and limitations of doing so. There are no cash accumulation values arising from a term policy, and everything paid for is lost to coverage, and once the policy is terminated, you have nothing at all to show for the years of coverage. The typical policy term lengths are 5, 10, 15, 20, or 30 years The typical premium options are level, annual renewable, or decreasing benefit upon death.

- Permanent life insurance. There are several subtypes of permanent life insurance to consider:

- Whole life insurance ensures coverage for the entirety of your life. The policy includes a cash value component that grows over time through a portion of your premium payments and accrued interest. Whole life insurance policies come with assurances that premiums will not increase, the death benefit will remain constant, and the cash value will earn a fixed rate of return. Whole life insurance is suitable for individuals seeking lifelong protection and are willing to invest in the guaranteed benefits offered by the policy. Due to the guaranteed features, whole life insurance tends to be one of the more costly options for purchasing life insurance.

- Universal life insurance can be complex to comprehend due to the various types available, each with distinct features. Universal life may be more cost-effective than whole life insurance as it typically lacks the same level of guarantees. Certain forms of Universal life allow for flexibility in premium payments and adjustments to the death benefit, albeit within specific boundaries. Universal life policies commonly include a cash value element. Target audience: Universal life may be suitable for individuals seeking lifelong coverage. Some types of Universal life are designed for those interested in linking cash value gains to market performance (such as indexed and variable universal life insurance). Drawbacks: Not all Universal life policies assure gains if cash value is your primary concern. Additionally, if you prefer flexible premium payments, it is essential to monitor your policy’s status to prevent fees and charges from depleting your cash value and causing the policy to lapse. It is crucial to understand what is guaranteed and what is not within a Universal life policy.

- Burial insurance/funeral insurance may be referred to as burial, funeral, or final expense insurance. Despite the name, it typically consists of a small whole life insurance policy designed to cover funeral costs and other final expenses. Burial insurance is commonly presented as a policy that guarantees acceptance without the need for a medical examination. Who is it intended for: These policies are generally aimed at individuals in poor health who lack other life insurance options and require coverage for funeral expenses. Drawbacks: Burial insurance policies can be costly, depending on the coverage amount provided. Additionally, burial insurance policies include a protection measure for the insurance company: If the policyholder passes away within two or three years of purchasing the policy, beneficiaries may not receive the full death benefit. It is important to review the policy’s terms regarding these “graded death benefits.” In such cases, beneficiaries may only receive a refund of the premiums paid, along with some interest.

- Survivorship life insurance/joint life insurance ensure two individuals under one policy, such as a husband and wife. The payout to beneficiaries is made when both have passed away. They may be referred to as second-to-die life insurance, but the industry is moving away from this name for understandable reasons. Survivorship life insurance can be a more cost-effective option than purchasing two separate life insurance policies, particularly if one of the individuals has health issues. Who is it for: Survivorship policies can be advantageous in estate planning when the life insurance money is not required by a beneficiary until both of the insured individuals have passed away. Survivorship life insurance might be utilized to fund a trust, for instance. It is also suitable for high net worth couples who wish to provide funds to heirs for estate taxes. Alternatively, it could be used by a couple to make a charitable donation. Downside: If two spouses are insured and one would face financial hardship if the other passed away, this is not the appropriate policy type. The surviving spouse does not receive any life insurance benefits. The payout is only made when both have passed away.

- Supplemental insurance provided through your workplace is commonly referred to as group life insurance. Premium rates are determined based on the group as a whole, rather than individual circumstances. Group life insurance is a cost-effective option since it is often offered at no cost or at a low price. It serves as a valuable supplement to your personal life insurance policy. The main drawback is that if you change jobs, you may also lose the life insurance coverage associated with it. This highlights the importance of having a separate life insurance policy that is not dependent on your employment status. Additionally, with an individual policy, you have the flexibility to purchase higher coverage amounts.

- Credit life insurance is type of insurance is designed to cover a specific debt. When obtaining a loan, you may have the option to purchase credit life insurance, with the premiums typically included in your loan payments. However, it’s important to note that the life insurance payout goes directly to the lender, not to your family. If you’re worried about how your family would manage a particular debt in the event of your passing, credit life insurance may seem like an attractive and convenient option, especially since it doesn’t require a medical examination to qualify. Despite its appeal, credit life insurance is limited in scope and doesn’t provide the financial flexibility that other types of insurance, such as term life insurance, can offer. Opting for term life insurance would likely be more beneficial, as it can address a wider range of concerns, including debt, income replacement, and funeral expenses, giving your family more financial security in the event of your death.

- Mortgage life insurance is similar to a credit life policy, and is specifically designed to only cover the remaining balance of a mortgage and nothing else. This type of policy differs from other life insurance types in two significant ways:

- The death benefit is paid to the mortgage lender, not a beneficiary of your choosing.

- The payout is the balance of the mortgage, or a partial balance if that is what you insured.

This type of insurance is intended for individuals who are primarily concerned about their family being burdened by the mortgage in the event of their passing. It may also be appealing to those who do not wish to undergo a medical examination to purchase life insurance. However, the downside of this policy is that it does not offer financial flexibility for your family, as the payout goes directly to your mortgage lender. If you are seeking life insurance to cover a mortgage or other debts, it is better to opt for term life insurance. With term life insurance, you can choose the length and amount of coverage, and provide more than just mortgage funds to your family. The payout can be used for any purpose, offering your family greater flexibility in how they use the money.

Cute Puppies Cause You to Burst Into Flames Redux courtesy of Openverse

- What is pet insurance? Pet insurance is similar to human health insurance in that it covers the cost of medical care for your pet. It is designed to cover unexpected costs, so it may not pay for routine care or pre-existing conditions.. Which pet insurance plan is most suitable for my needs? There are three primary types of pet insurance plans available:

- Accident and illness coverage is the most common type of pet insurance, providing coverage for treatment related to illnesses and accidental injuries.

- Accident-only coverage typically more budget-friendly and cover incidents like swallowing a toy or being hit by a car, but do not include coverage for illnesses such as diabetes or arthritis.

- Wellness or preventive care coverage is coverage is often an additional option to the above policies, covering expenses for routine care such as well visits, vaccines, and preventive treatments.

car accident @ vestavia hills courtesy of Openverse

🛡️ Have Proper Insurance Coverage

While insurance may not cover every scenario, it can help reduce the financial burden in case of a disaster. It is essential to also assess your car and life insurance policies. Health insurance enrollment happens yearly at varying times, so knowing your enrollment period enables you to make essential changes. Make sure that you have proper coverage now, while you have a choice to obtain a policy. You cannot wait until a disaster strikes, it would be too late to secure your needs. Happy Insurance Awareness Day!

Life insurance certificate issued by the Yorkshire Fire & Life Insurance Company to Samuel Holt, Liverpool, England, 1851. On display at the British Museum in London courtesy of Openverse

Insurance Awareness Day

Nice to have… Hope we don’t need to use it.

Thank you for sharing this important information