Today is National Life Insurance Day for the year 2025! The floating holiday (first Friday in May) is poised to focus attention on having life insurance. . .

What’s Your Family’s Appetite for Life Insurance courtesy of Openverse

National Life Insurance Day is celebrated annually in May to honor having a policy to take care of family when you are no longer here anymore. I wish I could have instilled the value of having a policy when I lost my brother in January. Life is hard enough with having life insurance, but not having any can project the cost of thousands and thousands of dollars onto your family. If you are on Medicare, depending on a government bailout will present itself to be a disaster to your family. The only sure way to avoid projecting a lot of the pain and agony onto your family, is to have life insurance.

👨💼 The Value of Life Insurance:

Numerous reasons exist to explain the significance of life insurance; however, the primary reason is to safeguard your family’s financial stability and provide them with peace of mind. If your income supports anyone, they would likely face difficulties in the event of your passing. This underscores the necessity of having life insurance. While various types of life insurance policies are available, they all fundamentally provide financial support to your beneficiaries upon your death. The funds from life insurance can be utilized to manage everyday living costs, mortgage or rent obligations, outstanding debts, educational expenses, and other vital financial needs. Life insurance serves as the most effective means to ensure that your loved ones remain financially secure in your absence.

Low Life… Insurance Premiums? courtesy of Openverse

👩💼 Exactly What Does Life Insurance Cover:

Life insurance provides coverage for nearly all types of living expenses, including several common costs such as:

- Immediate Expenses

- Funeral and burial costs

- Uncovered medical expenses

- Mortgage or rent

- Car loans

- Credit card debt

- Taxes

- Estate settlement costs

- Ongoing Expenses

- Food

- Housing

- Utilities

- Transportation

- Health care and insurance

- Continue a family business

- Future Expenses

- College costs

- Retirement

📋 Why the Need for Life Insurance?

Individuals who are financially relied upon by others are likely candidates for life insurance. This type of insurance offers financial support to your family or loved ones following your passing. The funds, referred to as the death benefit, serve to replace your income and cover various unpaid contributions you make to your household. Your family can utilize this benefit to manage expenses such as funeral costs, mortgage payments, college tuition, and more. Several groups of individuals frequently affirm the necessity of life insurance, including:

- Couples who are married or in partnerships often struggle to maintain financial stability without the income of both partners.

- Couples with children face additional challenges, as the surviving parent may need to cover childcare costs and other expenses without the support of the other parent.

- Single parents, being the sole providers for their families, should consider how to secure financial support for their children.

- Stay-at-home parents, who undertake numerous essential tasks such as meal preparation, school transportation, and homework assistance, also contribute significantly to the household, making life insurance a prudent consideration.

- Individuals in the empty nest stage often find that life insurance is essential for sustaining the lifestyle they have diligently built, especially for surviving partners.

- Retirees should be aware that their heirs may face estate taxes as high as 45%, depending on the estate’s value; however, the proceeds from a life insurance policy can provide tax-exempt funds to cover immediate expenses and beyond.

- For business owners, life insurance serves multiple purposes, particularly in the event of the death of an owner or a crucial employee.

226 term life courtesy of Openverse

👵 Different Types of Life Insurance Policies:

Life insurance is generally categorized into two main types: term life insurance and permanent life insurance.

- Term life insurance offers coverage for a designated period, typically 10, 20, or 30 years. It is ideal for those seeking protection for a specific duration, such as until their children complete college or their mortgage is settled. This type of insurance usually provides the highest coverage at the lowest initial premium, making it a suitable option for individuals with budget constraints.

- Permanent life insurance offers lifelong coverage as long as premiums are paid. It also builds cash value on a tax-deferred basis, which can be utilized for various purposes, including purchasing a home, enhancing retirement income, or addressing unexpected expenses. Due to these added benefits, the initial premiums for permanent life insurance are generally higher than those for term life insurance policies with equivalent coverage.

👩💼 About the Cost of Life Insurance Coverage:

The cost of life insurance is influenced by four primary factors: your age, health status, the type of policy selected, and the amount of coverage purchased. Generally, younger and healthier individuals will pay lower premiums. Additionally, term life insurance policies are usually less expensive than permanent life insurance policies. However, it is important not to let age or health concerns deter you from exploring life insurance options. There are policies available for individuals of all ages, including those with conditions such as high blood pressure, diabetes, and a history of smoking. It is important to note that premiums may be higher for those in poor health or who smoke. For instance, if you consistently pay $13 per month for your policy, your beneficiaries would receive $250,000 in the event of your death within the 20-year term.

👩💼 How Much Life Insurance Coverage is Right?

The amount of life insurance one should purchase is contingent upon the individuals one wishes to financially safeguard and the duration of that protection. To gain a general understanding, consider the following steps:

- Calculate the immediate, ongoing, and future expenses that your family or loved ones would face in the event of your passing. This may encompass costs such as funeral expenses, rent or mortgage payments, and college tuition.

- Assess the financial resources that your loved ones currently possess, which may include a spouse’s income and any existing life insurance policies.

- Deduct your available financial resources from the projected expenses. The resulting figure will provide an estimate of the necessary life insurance coverage.

As a general guideline, experts suggest that individuals should aim for life insurance coverage amounting to 10 to 15 times their gross income; however, many may require even greater coverage. Getting in touch with a few life insurance agents will help assisting in your after-life future’s success.

Sugar Land Term Life Insurance Policies courtesy of Openverse

👩💼 Who Can I Nominate to Be a Life Insurance Beneficiary?

A life insurance beneficiary refers to an individual, group of individuals, trust, charitable organization, or estate entitled to receive the benefits from your life insurance policy upon your passing. Typically, you will be required to designate two types of beneficiaries: a primary beneficiary and a secondary beneficiary. The secondary beneficiary, often referred to as a contingent beneficiary, will receive the benefits if the primary beneficiary is no longer living. You have the option to name multiple beneficiaries and specify the percentage of the payout allocated to each; for example, you might assign 50% to a spouse and 50% to an adult child. Additionally, there are specific considerations to take into account when naming minors or designating a charity or your estate as a beneficiary of your life insurance policy.

👩💼 The Process of Getting Life Insurance Coverage:

When applying for life insurance, your application is subjected to a process known as underwriting, which involves assessing your insurance risk. The approval and associated costs depend on your risk classification. There are two primary types of underwriting: traditional and simplified. Traditional underwriting requires you to complete a formal application and typically involves a brief medical examination, with approval potentially taking several weeks. Conversely, simplified underwriting allows for a rapid online application process that does not necessitate a medical exam, often resulting in immediate life insurance coverage. However, it is important to note that the coverage amount may be restricted and the costs may be higher with simplified underwriting.

👩💼 What if I Get Denied Life Insurance Coverage?

If your application for life insurance is initially rejected, there are several alternatives available. The first step is to reach out to the insurance company to determine if there was an error in your application. If no error exists, inquire about the specific reasons for the denial. With this information, you can seek assistance from a financial expert who specializes in applicants considered to be higher risk.

👩💼 Reviewing My Current Life Insurance Policy:

As a general guideline, it is advisable to consult with a financial expert at least annually or whenever significant life changes occur. Reviewing your life insurance will help confirm that your coverage adequately protects your loved ones. Life insurance typically requires adjustments following major events such as marriage, childbirth, starting a business, or retirement. In such cases, it is important to arrange a life insurance review with a financial professional promptly.

👩💼 Are There Living Benefits to Life Insurance Coverage?

The living benefits of a life insurance policy allow you to utilize your insurance proceeds prior to your death. This feature is generally intended for circumstances where an individual is confronted with a terminal illness or severe injury. Numerous individuals utilize funds from living benefits to organize their family’s financial situation or to embark on a memorable journey. Living benefits, often referred to as accelerated death benefits, are usually offered as an additional rider or endorsement to your life insurance policy.

👩💼 How Life Insurance Pays Out:

Typically, the life insurance benefit is disbursed as a lump sum to the beneficiaries upon the death of the policyholder. To obtain this benefit, a claim must be submitted to the insurance company, which requires a certified copy of the death certificate for claim processing. The duration for receiving the life insurance payment can vary, with most insurers processing claims within 30 to 60 days after receipt. However, delays may occur, particularly if the policyholder passes away within two years of policy issuance or if there are extenuating circumstances. Additionally, some insurers may deny claims if the policyholder’s death resulted from illegal activities or if there were misrepresentations on the insurance application. The payout structure may differ if an installment or annuity option is selected.

Photo by Melissa Askew on Unsplash

It is sure to see that having a policy for your loved one’s before leaving this life on Earth is detrimental to what the legacy and viewpoint will be into the future. You really don’t want to leave a lot of pain, agony and expense to those you love, when you have to leave. Life insurance is well worth thinking about well in advance. Life insurance and a will makes it much easier, but we will get to a will at a later date. The sooner in life you start paying for a life insurance to less per month, year, or whatever structure the premium will be. So make today a day to make a difference. Call a life insurance agent today and evaluate between at least 3 companies first Your legacy is at stake!

Hashtags:

#HappyNationalLifeInsuranceDay #NationalLifeInsuranceDay #LifeInsuranceDay #EmployeeEngagement ##Entrepreneur #EstatePlanning #Family #FinalExpense #Finance #FinancialAdvisor #FinancialFreedom #FinancialLiteracy #FinancialPlanning #FinancialServices #Health #IncomeProtection #Insurance #InsuranceAdvisor #InsuranceAgency #InsuranceAgent #InsuranceAgents #InsuranceBroker #InsuranceBrokers #InsuranceClaim #InsuranceCompany #InsuranceCoverage #InsuranceLife #InsurancePolicy #InsuranceQuote #InsuranceTips #Investing #Investment #Life #LifeInsurance #LifeInsuranceAgent #LifeInsuranceAwareness #LifeInsuranceMatters #LifeInsurancePolicy #Money #MortgageProtection #PersonalFinance #Protection #Retirement #RetirementPlanning #Savings #Seguros #TermInsurance #Wealth

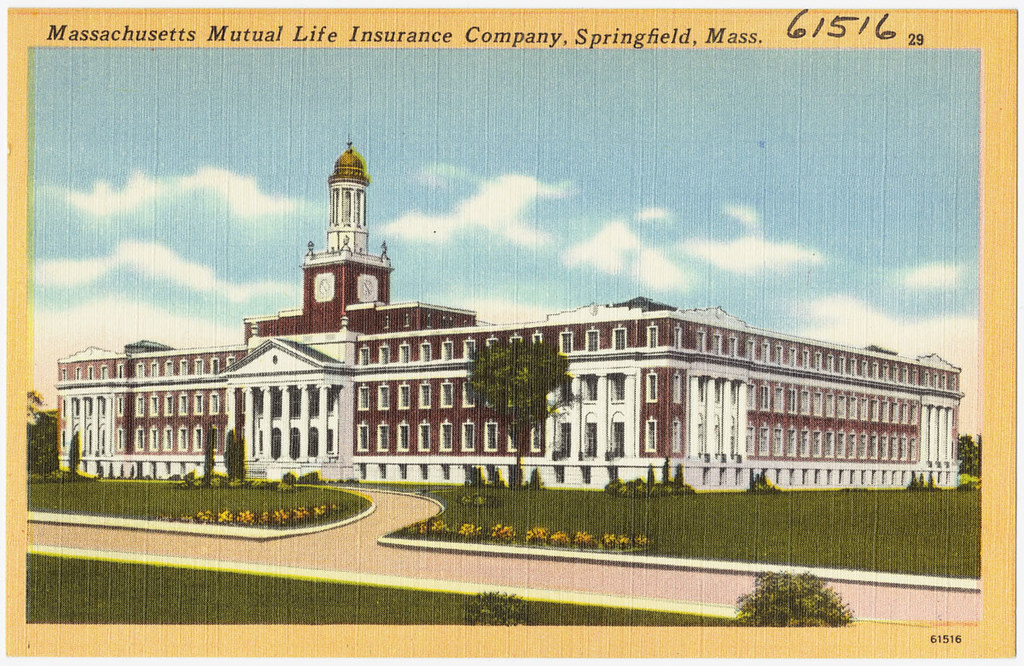

Massachusetts Mutual Life Insurance Company, Springfield, Mass. courtesy of Openverse

National Life Insurance Day

Thank you for sharing